Information about form 8908 energy efficient home credit including recent updates related forms and instructions on how to file.

Energy efficiency tax credit extension.

This credit is worth a maximum of 500 for all years combined from 2006 to its expiration.

Under the old rule those projects would have needed to become operational by the end of 2020 in order to claim the full 30 percent investment tax.

There s a lot of misinformation regarding whether the residential energy tax credit is still available or not.

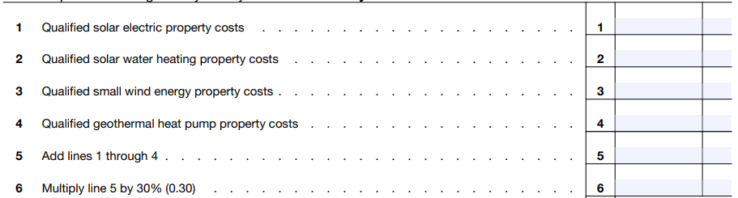

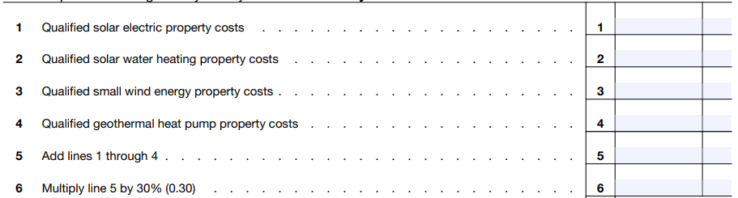

This tax credit is 30 percent of the cost of alternative energy equipment installed on or in a home.

The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020 tax credit.

Through recent passage of a new tax extenders bill the energy efficient home credit the 45l credit which provides eligible contractors with a 2 000 tax credit for each energy efficient dwelling unit has been retroactively extended for 2018 2019 and through the end of 2020.

After 2019 the credit sees its value gradually increased until 2021 when it will need to be renewed by congress or it will disappear entirely.

This is known as the residential renewable energy tax credit.

Residential energy efficient property credit.

Details of the nonbusiness energy property credit extended through december 31 2020 you can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

This includes the cost of installation.

Homeowners can claim a federal tax credit for making certain improvements to their homes or installing appliances that are designed to boost energy efficiency.

Qualified equipment includes solar hot water heaters solar electric equipment wind turbines and fuel cell property.

To put it simply it s still available in its entirety until 2019.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Solar wind geothermal and fuel cell technology are all eligible.

On wednesday may 27 the u s.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

10 of cost up to 500 or a specific amount from 50 300.